The benefits of using RoundPoint's online payment service extend beyond mere convenience. It provides a secure environment where homeowners can confidently manage their accounts with ease. The system is designed to be user-friendly, ensuring that even those who might be less familiar with technology can navigate the platform without any difficulties. Additionally, RoundPoint's online service offers a range of features that cater to different needs, such as setting up automatic payments, tracking payment history, and accessing account statements. This comprehensive service empowers homeowners to take control of their mortgage payments with minimal effort. Moreover, RoundPoint's commitment to customer satisfaction is evident in its online payment solutions. By offering a reliable and accessible platform, they ensure that homeowners can manage their financial commitments without stress. This article will delve into the various aspects of RoundPoint's online payment service, providing detailed insights into its features, benefits, and how it can be utilized effectively. Whether you're a new homeowner or someone looking to streamline your mortgage payment process, this guide offers valuable information to make the most of RoundPoint's online services.

| Table of Contents |

|---|

| 1. Understanding RoundPoint Mortgage Services |

| 2. Setting Up Your Online Account |

| 3. Features of RoundPoint Online Payment |

| 4. How to Make a Payment Online |

| 5. Security Measures and Privacy Protection |

| 6. Benefits of Online Mortgage Payment |

| 7. Automatic Payments Setup |

| 8. Troubleshooting Common Issues |

| 9. Frequently Asked Questions |

| 10. Customer Support and Resources |

| 11. RoundPoint Mobile App |

| 12. Managing Payment History |

| 13. Understanding Fees and Charges |

| 14. Comparing RoundPoint with Other Services |

| 15. Conclusion |

Understanding RoundPoint Mortgage Services

RoundPoint Mortgage Servicing Corporation is a leading mortgage servicer providing solutions to homeowners across the United States. Their services include managing mortgage payments, escrow accounts, and offering various customer support options. RoundPoint is committed to providing a seamless experience to its customers, ensuring that they have access to the necessary tools and information to manage their mortgage effectively.

The company offers a wide range of mortgage options tailored to meet the diverse needs of its clients. Whether you're a first-time homebuyer or someone looking to refinance, RoundPoint has a solution to suit your needs. Their expertise in the mortgage industry is backed by years of experience, making them a trusted partner for homeowners nationwide.

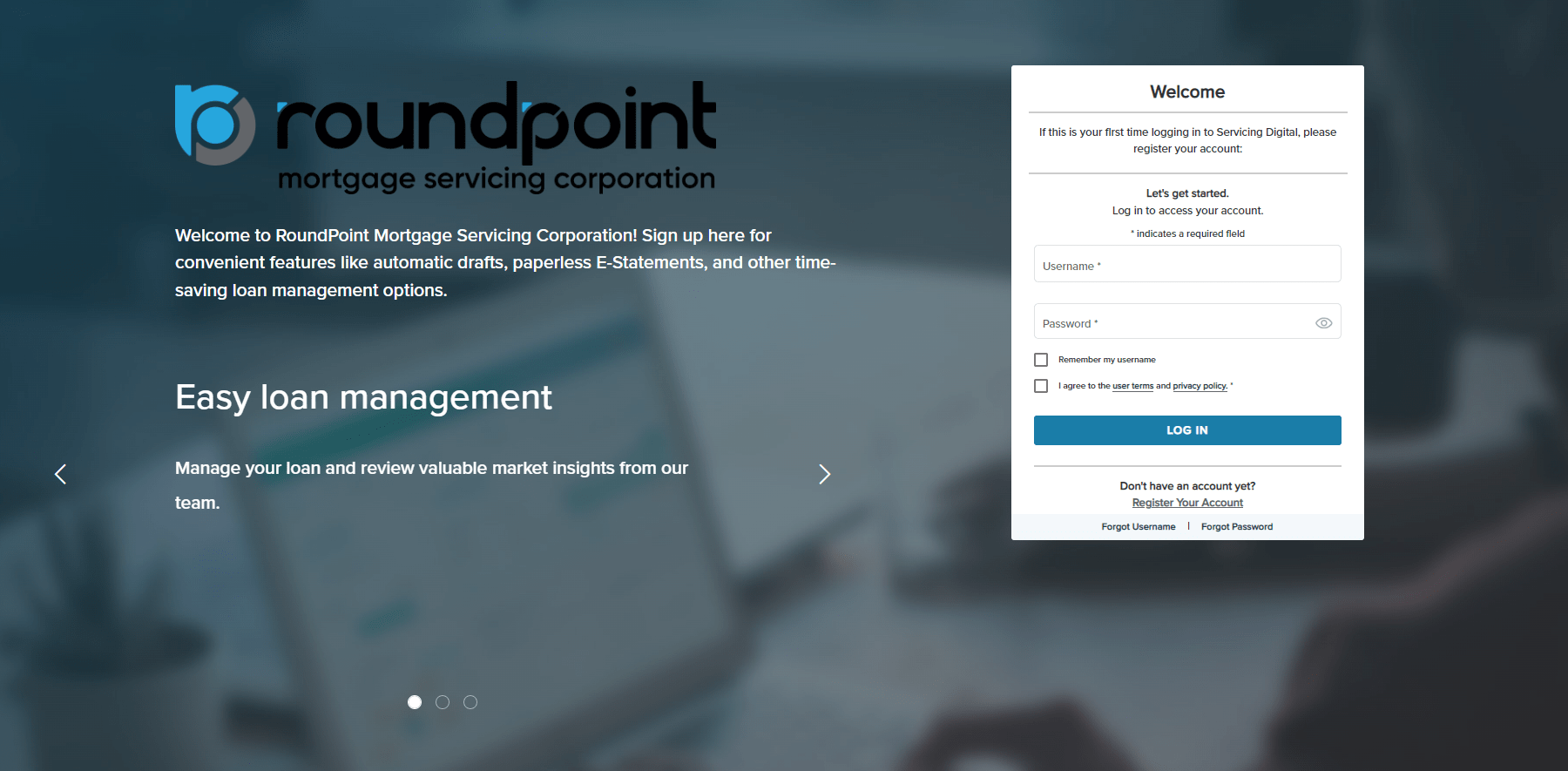

Setting Up Your Online Account

To take advantage of RoundPoint's online payment services, the first step is to set up an online account. This process is straightforward and can be completed in a few simple steps. You'll need to provide personal information, including your loan number and email address, to create your account. Once your account is set up, you'll have access to a dashboard where you can manage all aspects of your mortgage.

RoundPoint's online platform is designed to be intuitive, ensuring that users can easily navigate the various features available. From setting up automatic payments to accessing account statements, the platform offers a comprehensive suite of tools that make managing your mortgage a breeze.

Features of RoundPoint Online Payment

RoundPoint's online payment platform offers a variety of features designed to enhance the user experience. These include the ability to make one-time payments, set up recurring payments, and track payment history. Additionally, users can access account statements, update personal information, and contact customer support directly from the platform.

One of the standout features of RoundPoint's online payment service is its flexibility. Homeowners can choose the payment method that best suits their needs, whether it's through a bank account, credit card, or debit card. This flexibility ensures that payments can be made conveniently and on time, helping to avoid any potential late fees or penalties.

How to Make a Payment Online

Making a payment using RoundPoint's online platform is a simple process. Once you've logged into your account, you can navigate to the payment section and select the payment method you'd like to use. You'll need to enter the payment amount and confirm the transaction to complete the process.

For those who prefer a more hands-off approach, RoundPoint offers the option to set up automatic payments. This feature ensures that your mortgage payments are made on time each month, providing peace of mind and eliminating the need to remember due dates.

Security Measures and Privacy Protection

RoundPoint is committed to ensuring the security and privacy of its customers. Their online platform is equipped with state-of-the-art security measures to protect sensitive information. This includes data encryption, secure login protocols, and regular security audits to identify and address potential vulnerabilities.

In addition to these measures, RoundPoint adheres to strict privacy policies to ensure that customer information is handled responsibly. Users can trust that their data is safe when using RoundPoint's online services.

Benefits of Online Mortgage Payment

There are numerous benefits to using RoundPoint's online mortgage payment services. The most obvious is convenience. Homeowners can manage their mortgage from anywhere with internet access, eliminating the need to visit a physical location or send payments through the mail.

Online payments also provide greater control over your finances. With access to real-time account information, homeowners can make informed decisions about their mortgage and stay on top of their financial commitments. Additionally, the ability to set up automatic payments helps ensure that payments are never missed, reducing the risk of incurring late fees.

Automatic Payments Setup

Setting up automatic payments with RoundPoint is a great way to streamline your mortgage management. This feature allows you to schedule recurring payments, ensuring that your mortgage is paid on time each month without any manual intervention.

The process is easy to set up through your online account. Simply choose the payment frequency, enter the payment details, and confirm your settings. Once set up, RoundPoint will automatically deduct the specified amount from your account on the scheduled date.

Troubleshooting Common Issues

While RoundPoint's online payment service is designed to be user-friendly, some homeowners may encounter issues when using the platform. Common problems include difficulties logging in, payment processing errors, or issues with setting up automatic payments.

Fortunately, RoundPoint offers a range of resources to help troubleshoot these issues. Their comprehensive online help center provides step-by-step guides and FAQs to assist users in resolving common problems. Additionally, their customer support team is available to provide assistance if needed.

Frequently Asked Questions

1. How do I set up automatic payments with RoundPoint?

To set up automatic payments, log into your online account, navigate to the payment section, and select "Automatic Payments." Follow the prompts to choose your payment frequency, enter your payment details, and confirm your settings.

2. Can I make a one-time payment online?

Yes, you can make a one-time payment through RoundPoint's online platform. Simply log into your account, navigate to the payment section, enter the payment amount, and confirm the transaction.

3. What should I do if I can't log into my account?

If you're having trouble logging in, try resetting your password using the "Forgot Password" link on the login page. If the issue persists, contact RoundPoint customer support for assistance.

4. Is my personal information safe when using RoundPoint's online services?

Yes, RoundPoint employs robust security measures to protect your personal information, including data encryption and secure login protocols.

5. How can I contact RoundPoint customer support?

You can contact RoundPoint customer support through their online help center or by calling their dedicated support line for assistance with any issues you may encounter.

6. Are there any fees associated with using RoundPoint's online payment services?

RoundPoint does not charge additional fees for making payments online. However, it's important to review your account statements for any standard mortgage-related fees that may apply.

Customer Support and Resources

RoundPoint is dedicated to providing exceptional customer support to ensure a positive experience for its users. Their online help center is a valuable resource, offering comprehensive guides, FAQs, and troubleshooting tips to help users navigate the platform effectively.

For more personalized assistance, RoundPoint's customer support team is available to address any questions or concerns. They can be reached via email, phone, or live chat, ensuring that help is readily available when needed.

RoundPoint Mobile App

To further enhance the convenience of managing your mortgage, RoundPoint offers a mobile app that provides access to all the features available on the online platform. The app is designed for both iOS and Android devices, allowing homeowners to manage their mortgage on the go.

With the mobile app, users can make payments, set up automatic payments, view account statements, and contact customer support directly from their smartphone or tablet. This flexibility ensures that homeowners can stay connected with their mortgage account no matter where they are.

Managing Payment History

Tracking your payment history is an integral part of managing your mortgage. RoundPoint's online platform and mobile app provide easy access to your payment history, allowing you to view past payments and monitor your account activity.

This feature is particularly useful for homeowners who want to keep track of their payment patterns or verify that payments have been processed correctly. Accessing your payment history through RoundPoint's system is straightforward and can be done with just a few clicks.

Understanding Fees and Charges

While RoundPoint aims to provide a transparent and straightforward payment experience, it's important for homeowners to be aware of any fees or charges associated with their mortgage account. These may include standard mortgage-related fees such as late payment penalties or escrow account adjustments.

Homeowners can view any applicable fees or charges through their online account or by reviewing their account statements. Understanding these fees can help homeowners manage their finances more effectively and avoid unexpected costs.

Comparing RoundPoint with Other Services

When it comes to mortgage payment services, RoundPoint stands out for its comprehensive online platform and commitment to customer satisfaction. However, it's always a good idea to compare different service providers to ensure you're getting the best possible experience.

Factors to consider when comparing RoundPoint with other services include the range of features offered, ease of use, customer support options, and any associated fees. By evaluating these factors, homeowners can make an informed decision about which mortgage payment service best meets their needs.

Conclusion

RoundPoint's online mortgage payment service offers a convenient and efficient way for homeowners to manage their financial commitments. With a range of features designed to enhance user experience, secure and flexible payment options, and dedicated customer support, RoundPoint is a trusted partner for homeowners across the United States.

Whether you're new to online mortgage payments or a seasoned user, this service provides the tools and resources needed to manage your mortgage with confidence. By leveraging RoundPoint's innovative solutions, homeowners can enjoy a seamless and stress-free mortgage payment experience.

You Might Also Like

Mary Ellen Adcock: The Life And Career Of An Inspirational LeaderCornelius Dupre: Visionary Leader In Business And Innovation

Unstoppable Bull: A Phenomenon Of Strength And Resilience

Hawkeye Capital Management: A Guide To Strategic Financial Solutions

Essential Insights Into Defstartup Gaming: A World Of Digital Innovation

Article Recommendations