Mortgage insurance is often required by lenders when a borrower has less than 20% equity in their home. It acts as a safety net for lenders, covering losses if a borrower defaults on their loan. However, it can also benefit homeowners by allowing them to purchase a home with a smaller down payment. Knowing the ins and outs of how to file a claim is invaluable should you ever need to use this insurance. By familiarizing yourself with the RoundPoint Mortgage Insurance Claim process, you can ensure a smoother experience should the need arise. In this article, we will delve into the intricacies of the RoundPoint Mortgage Insurance Claim process, offering a step-by-step guide, tips for success, and answers to frequently asked questions. We'll also explore the benefits of mortgage insurance, common reasons for claims, and how to avoid common pitfalls. This guide is designed to provide clarity and confidence to all homeowners, ensuring they are well-prepared to manage their mortgage insurance needs effectively.

Table of Contents

1. Introduction to Mortgage Insurance 2. What is RoundPoint Mortgage Insurance? 3. The Importance of Mortgage Insurance for Homeowners 4. How to File a RoundPoint Mortgage Insurance Claim 5. Common Reasons for Filing a Mortgage Insurance Claim 6. Understanding the Claim Process Timeline 7. Documentation Required for a Successful Claim 8. Tips for a Smooth Claim Process 9. What to Expect After Filing a Claim 10. Common Issues and How to Overcome Them 11. The Financial Implications of a Mortgage Insurance Claim 12. How to Choose the Right Mortgage Insurance 13. The Role of RoundPoint in the Insurance Claim Process 14. Legal Considerations in Mortgage Insurance Claims 15. Frequently Asked Questions

Introduction to Mortgage Insurance

Mortgage insurance is a type of insurance policy that protects lenders from losses if a borrower defaults on their mortgage. It is typically required when a borrower makes a down payment of less than 20% of the home's value. This insurance allows prospective homeowners to purchase a home without the need for a large down payment, making homeownership more accessible to a broader audience.

Mortgage insurance can come in various forms, including private mortgage insurance (PMI) for conventional loans, mortgage insurance premium (MIP) for FHA loans, and other types tailored to specific lending programs. Each type has its own set of guidelines, costs, and benefits, but the primary goal remains the same: to reduce the risk for lenders.

While mortgage insurance primarily benefits lenders, it also offers advantages to borrowers. By enabling smaller down payments, it increases the pool of eligible buyers, allowing more people to enter the housing market. Understanding the specifics of your mortgage insurance policy, including the coverage it provides and the process for filing a claim, is crucial for all homeowners.

What is RoundPoint Mortgage Insurance?

RoundPoint Mortgage Insurance is a service offered by RoundPoint Mortgage Servicing Corporation, a leading non-bank mortgage servicing company. RoundPoint provides a range of mortgage services, including mortgage insurance, to help homeowners manage their mortgage payments and protect their investment. The company's insurance services are designed to support homeowners in times of financial hardship or unforeseen events.

RoundPoint Mortgage Insurance offers coverage that helps borrowers by mitigating the financial impact of events that could lead to loan default. This includes situations such as job loss, disability, or other circumstances that might prevent a borrower from making mortgage payments. By offering this safety net, RoundPoint helps ensure that both lenders and borrowers are protected.

The mortgage insurance offered by RoundPoint is tailored to meet the needs of its customers, with flexible terms and conditions. Understanding the specifics of your RoundPoint Mortgage Insurance policy is essential for taking full advantage of the coverage and services available to you.

The Importance of Mortgage Insurance for Homeowners

For homeowners, mortgage insurance serves as a critical component of financial planning and stability. It provides peace of mind by ensuring that in the event of financial hardship, the homeowner's investment is protected. This protection is particularly important for those who have made a smaller down payment, as they have less equity in their home.

Mortgage insurance can also facilitate the purchase of a home for those who may not have been able to do so otherwise. By reducing the amount of upfront cash needed, more individuals and families can achieve the dream of homeownership. This can be especially beneficial in markets where home prices are high, and saving for a large down payment is challenging.

Additionally, mortgage insurance can sometimes offer benefits beyond just default protection. Some policies may include unemployment protection, which provides temporary payment relief if the borrower loses their job. Understanding these additional benefits can help homeowners make informed decisions about their mortgage insurance options.

How to File a RoundPoint Mortgage Insurance Claim

Filing a RoundPoint Mortgage Insurance Claim involves several key steps that are essential for a successful outcome. The first step is to thoroughly review your mortgage insurance policy to understand the coverage and specific conditions under which a claim can be filed. This information will guide you through the process and help you gather the necessary documentation.

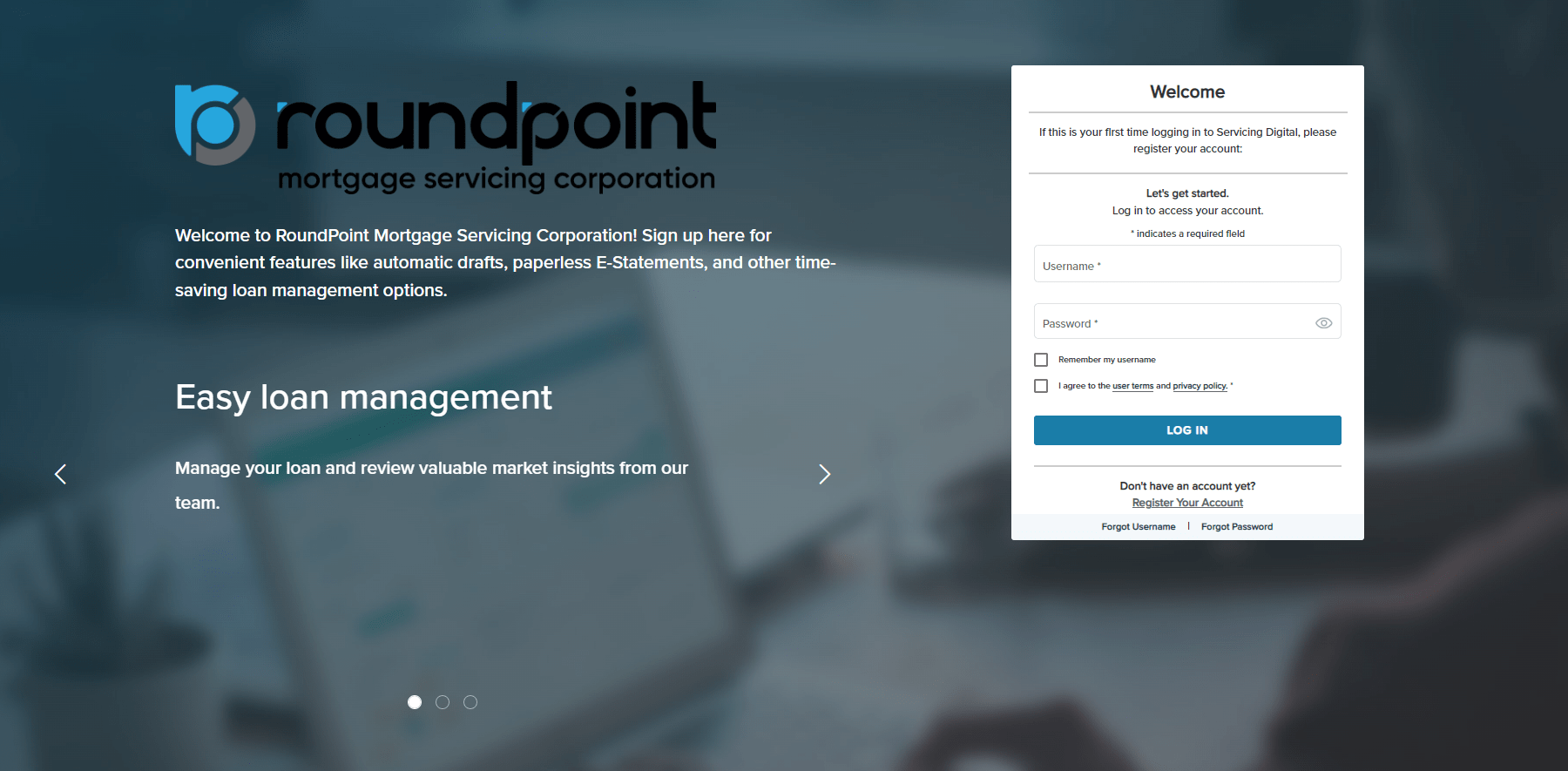

Once you have reviewed your policy, the next step is to contact RoundPoint's customer service or claims department. They will provide you with the necessary forms and instructions for filing your claim. It's important to provide accurate and complete information to avoid delays in processing. Be prepared to submit supporting documentation, such as proof of financial hardship or other relevant information.

After submitting your claim, RoundPoint will review the documentation and assess the validity of the claim. This process may involve additional communication or requests for further information. Staying proactive and responsive during this time is crucial to ensure a smooth and timely resolution.

Common Reasons for Filing a Mortgage Insurance Claim

There are several common reasons why homeowners may need to file a mortgage insurance claim. One of the most frequent reasons is job loss, which can significantly impact a homeowner's ability to make mortgage payments. In such cases, mortgage insurance can provide temporary relief by covering missed payments or offering other forms of assistance.

Another common reason for filing a claim is disability or illness, which can prevent a homeowner from working and earning an income. Mortgage insurance can offer support in these situations, helping to maintain the homeownership status while the borrower recovers.

Other reasons for filing a claim may include natural disasters or other events that cause significant damage to the property, making it uninhabitable or requiring expensive repairs. Understanding these common scenarios can help homeowners prepare and respond effectively if they find themselves in a similar situation.

Understanding the Claim Process Timeline

The timeline for processing a RoundPoint Mortgage Insurance Claim can vary depending on several factors, including the complexity of the claim and the completeness of the submitted documentation. On average, the process can take anywhere from a few weeks to several months.

Initially, after submitting the claim, RoundPoint will conduct a preliminary review to ensure all required information is included. This step typically takes a few days to a week. If additional information is needed, the homeowner will be notified, and the processing time may be extended.

Once the initial review is complete, the claim will undergo a more detailed assessment. This phase involves verifying the information and evaluating the circumstances of the claim. Depending on the nature of the claim, this process can take several weeks.

After the detailed assessment is completed, RoundPoint will make a decision regarding the claim. If approved, the necessary payments or arrangements will be made to fulfill the claim. It's important for homeowners to remain patient and communicative throughout the process to ensure a positive outcome.

Documentation Required for a Successful Claim

Submitting the correct documentation is a critical component of a successful RoundPoint Mortgage Insurance Claim. The specific documents required can vary based on the nature of the claim, but there are several common items that homeowners should be prepared to provide.

Proof of financial hardship is often required, which may include recent pay stubs, tax returns, or unemployment benefits statements. Additionally, documentation related to the specific event prompting the claim, such as medical records or repair estimates, may be necessary.

Homeowners should also be prepared to provide information about their mortgage, including the loan number, payment history, and details about the property. Having these documents organized and readily available can expedite the claim process and increase the likelihood of approval.

Tips for a Smooth Claim Process

To ensure a smooth RoundPoint Mortgage Insurance Claim process, homeowners should follow several key tips. First, it's essential to thoroughly review your mortgage insurance policy and understand the coverage and conditions. This knowledge will guide your actions and help you avoid common pitfalls.

Next, when filing a claim, ensure all documentation is complete and accurate. Double-check forms and information before submission to prevent delays caused by missing or incorrect details. It's also beneficial to keep copies of all documents for your records.

Communication is another critical aspect of a smooth claim process. Stay in contact with RoundPoint's claims department and promptly respond to any requests for additional information. This proactive approach can help resolve issues quickly and keep the process moving forward.

What to Expect After Filing a Claim

After filing a RoundPoint Mortgage Insurance Claim, homeowners can expect several steps to follow. Initially, there will be a review period during which RoundPoint assesses the claim and determines if additional information is needed. This phase may involve communication with the claims department to clarify details.

If the claim is approved, RoundPoint will outline the steps for receiving the benefits or assistance outlined in the policy. This may include direct payments, temporary payment relief, or other arrangements based on the specifics of the claim.

Homeowners should also be prepared for the possibility of an appeal process if the claim is denied. Understanding the reasons for denial and providing additional information or documentation can sometimes reverse the decision.

Common Issues and How to Overcome Them

Several common issues can arise during the RoundPoint Mortgage Insurance Claim process, but understanding and preparing for these challenges can help homeowners overcome them effectively. One common issue is incomplete or inaccurate documentation, which can delay the processing time. Homeowners should carefully review all forms and information before submission.

Another issue is misunderstandings about the coverage or conditions of the mortgage insurance policy. Homeowners should take the time to thoroughly read their policy and seek clarification from RoundPoint if needed. This will help prevent filing claims that are not covered or eligible for assistance.

Finally, communication breakdowns can also pose a challenge. Maintaining open lines of communication with RoundPoint's claims department and promptly responding to requests for information can help resolve issues quickly and keep the process on track.

The Financial Implications of a Mortgage Insurance Claim

Filing a RoundPoint Mortgage Insurance Claim can have various financial implications for homeowners. On the positive side, a successful claim can provide much-needed financial relief during difficult times, helping homeowners avoid foreclosure or other negative outcomes.

However, it's important to be aware of potential long-term financial impacts. For example, filing a claim may affect the homeowner's credit score or eligibility for future loans. Understanding these implications and weighing them against the immediate benefits of filing a claim is crucial for making informed decisions.

Homeowners should also consider the potential costs associated with filing a claim, such as fees for documentation or legal assistance. Being prepared for these expenses can help homeowners navigate the claim process more effectively.

How to Choose the Right Mortgage Insurance

Choosing the right mortgage insurance is a critical decision for homeowners, as it can impact their financial security and peace of mind. When evaluating options, homeowners should consider factors such as the coverage provided, the cost of the insurance, and the reputation of the insurer.

It's important to compare different policies and understand the terms and conditions associated with each. Homeowners should also consider their personal financial situation and risk tolerance when selecting a policy. Consulting with a financial advisor or insurance professional can provide valuable insights and guidance.

Ultimately, the right mortgage insurance will provide the necessary protection and support for homeowners while aligning with their financial goals and needs. Taking the time to research and evaluate options can lead to a more confident and informed decision.

The Role of RoundPoint in the Insurance Claim Process

RoundPoint plays a critical role in the mortgage insurance claim process, providing support and guidance to homeowners throughout. As a leading mortgage servicing company, RoundPoint is committed to helping homeowners navigate the complexities of filing a claim and ensuring a smooth and successful outcome.

RoundPoint's claims department is responsible for reviewing and assessing claims, communicating with homeowners, and facilitating the necessary payments or arrangements. Their expertise and experience in the industry make them a valuable resource for homeowners seeking assistance with their mortgage insurance needs.

By partnering with RoundPoint, homeowners can benefit from their comprehensive services and support, ensuring they are well-prepared to manage their mortgage insurance claims effectively.

Legal Considerations in Mortgage Insurance Claims

There are several legal considerations that homeowners should be aware of when filing a RoundPoint Mortgage Insurance Claim. Understanding these legal aspects can help homeowners protect their rights and ensure that the claim process is conducted fairly and transparently.

One key legal consideration is the terms and conditions outlined in the mortgage insurance policy. Homeowners should carefully review their policy to understand their rights and responsibilities, as well as any limitations or exclusions that may apply.

In some cases, legal assistance may be necessary to resolve disputes or navigate complex claim situations. Homeowners should be prepared to seek legal advice if needed and understand the potential costs and benefits of doing so.

Frequently Asked Questions

1. What is the purpose of mortgage insurance?

Mortgage insurance protects lenders from losses if a borrower defaults on their mortgage. It allows homeowners to purchase a home with a smaller down payment and provides a safety net for lenders.

2. How do I know if I need to file a RoundPoint Mortgage Insurance Claim?

If you are experiencing financial hardship or an event that affects your ability to make mortgage payments, you may need to file a claim. Review your policy and contact RoundPoint for guidance.

3. What documentation is required for a RoundPoint Mortgage Insurance Claim?

Common documentation includes proof of financial hardship, mortgage information, and details about the event prompting the claim. Specific requirements may vary based on the nature of the claim.

4. How long does the RoundPoint Mortgage Insurance Claim process take?

The timeline can vary, but the process typically takes a few weeks to several months, depending on the complexity of the claim and the completeness of the documentation.

5. Can filing a claim affect my credit score?

Filing a claim may have implications for your credit score, depending on the specifics of the claim and your financial situation. It's important to weigh these potential impacts against the benefits of filing a claim.

6. What should I do if my claim is denied?

If your claim is denied, review the reasons for denial and consider providing additional information or documentation. You may also consider seeking legal advice or appealing the decision.

Conclusion

RoundPoint Mortgage Insurance Claims play a vital role in protecting homeowners and lenders alike. By understanding the process, benefits, and potential challenges, homeowners can navigate their mortgage insurance needs with confidence. Whether you're considering filing a claim or simply want to be prepared for the future, this guide provides the knowledge and resources necessary for success. Remember, staying informed and proactive is key to ensuring your financial stability and achieving your homeownership goals.

For more detailed information and resources, visit Consumer Financial Protection Bureau, which offers valuable insights and guidance on mortgage insurance and related topics.

You Might Also Like

Joe Rogan's Ritual: The Intrigue Of Drinking Elk BloodMetin Negrin: A Visionary Leader In Real Estate And Beyond

Predicting Ethereum Meta Prices: A Comprehensive Guide

Your Guide To TradeZella Price: Everything You Need To Know

The Intricacies And Applications Of 176 Divided By 11

Article Recommendations