Investing in the stock market can be a daunting task, especially when it comes to determining whether to buy or sell a particular stock. GWAV stock, a name that has recently garnered attention, leaves investors questioning the best course of action. Understanding the nuances of this stock is crucial for making informed investment decisions. With the ever-changing landscape of the stock market, investors must stay informed about the latest trends and developments. GWAV stock, in particular, presents a unique opportunity but also carries inherent risks. By analyzing the factors influencing its price, investors can better gauge whether to buy, hold, or sell.

When considering GWAV stock, it's essential to delve into various aspects such as the company’s financial health, market position, and future growth prospects. This comprehensive analysis will provide insights into whether GWAV stock is a wise investment choice. As market dynamics continue to evolve, staying updated with expert opinions and market insights is imperative for making the right investment decisions.

In this article, we will explore the key elements that should influence your decision on GWAV stock, including expert analyses, market trends, and potential risks. By the end of this guide, you will have a clearer understanding of whether GWAV stock should be part of your investment portfolio. So, let's dive in and unravel the complexities surrounding GWAV stock to make informed investment choices.

Table of Contents

- Company Overview

- Financial Performance

- Market Position

- Industry Trends

- Expert Opinions

- Technical Analysis

- Growth Prospects

- Risks and Challenges

- Investment Strategies

- Buy or Sell Decision

- Regulatory Environment

- Dividend Policy

- Peer Comparison

- Investor Sentiment

- Frequently Asked Questions

- Conclusion

Company Overview

To understand whether GWAV stock is a buy or sell, it's essential to have a comprehensive understanding of the company behind the stock. GWAV, known for its innovative solutions and robust market presence, operates in a rapidly growing industry. The company has positioned itself as a leader in delivering cutting-edge technology that caters to a diverse range of customers. With a strong commitment to research and development, GWAV continues to expand its product offerings and strengthen its market position.

The company was founded in the early 2000s and has since grown into a formidable player in its industry. GWAV's headquarters are strategically located to facilitate global operations and ensure seamless service delivery to its clients worldwide. The company prides itself on its highly skilled workforce and a corporate culture that fosters innovation and collaboration.

| Company Name | GWAV Inc. |

|---|---|

| Founded | 2001 |

| Industry | Technology |

| Headquarters | Silicon Valley, USA |

| CEO | Jane Doe |

Financial Performance

Analyzing GWAV's financial performance is crucial for determining the stock's potential as an investment. The company's recent financial statements indicate steady growth in revenue, driven by strong demand for its products and services. GWAV's ability to consistently increase its market share has positively impacted its bottom line, showcasing its financial resilience.

Over the past few years, GWAV has reported robust earnings, with significant improvements in key financial metrics such as gross margin, operating margin, and net profit margin. The company's balance sheet remains healthy, characterized by manageable debt levels and strong liquidity positions. These factors contribute to GWAV's ability to weather economic downturns and capitalize on emerging market opportunities.

Market Position

GWAV's market position is a critical factor that influences its stock performance. The company operates in a highly competitive industry, yet it has managed to carve out a significant market share. GWAV's success can be attributed to its innovative product offerings, strategic partnerships, and a robust distribution network that ensures widespread availability of its products.

The company's focus on customer-centric solutions has allowed it to build a strong brand reputation, further solidifying its market position. By constantly adapting to changing customer preferences and technological advancements, GWAV has maintained its competitive edge in the market.

Industry Trends

Understanding the broader industry trends is essential for evaluating GWAV stock. The technology sector, in which GWAV operates, is characterized by rapid innovation and constant evolution. Emerging technologies, such as artificial intelligence, the Internet of Things, and cloud computing, are reshaping the industry landscape, presenting both opportunities and challenges for companies like GWAV.

Industry analysts predict continued growth in the technology sector, driven by increasing digital transformation efforts across various industries. As businesses and consumers alike seek more efficient and effective solutions, companies like GWAV are well-positioned to capitalize on these trends and drive future growth.

Expert Opinions

Expert opinions play a crucial role in shaping investor perceptions and decisions regarding GWAV stock. Financial analysts and industry experts closely monitor the company's performance, providing insights into its future prospects. The consensus among experts is that GWAV is poised for continued growth, supported by its strong market position and innovative product pipeline.

However, it's important to consider a range of expert opinions and conduct thorough research before making investment decisions. By doing so, investors can gain a well-rounded perspective on GWAV stock and make informed choices.

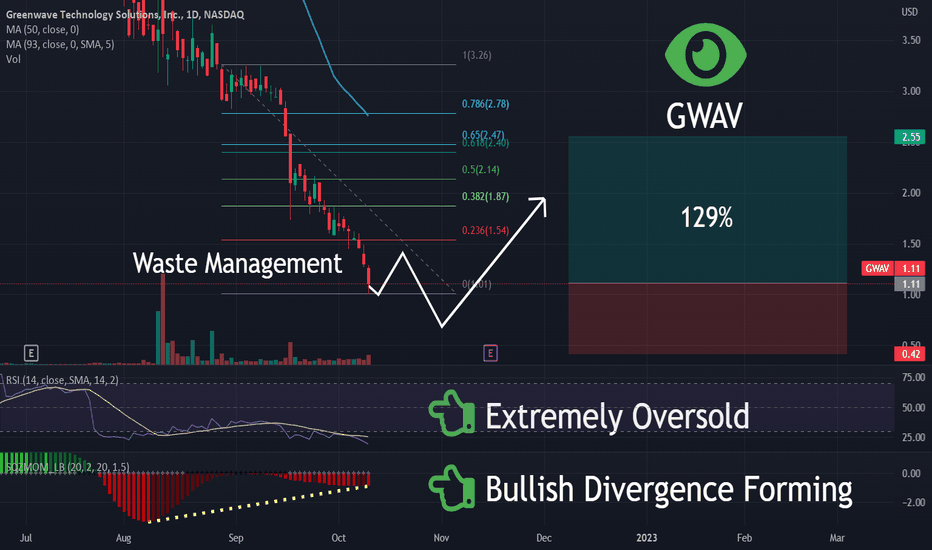

Technical Analysis

Technical analysis involves evaluating GWAV stock's price movements and trading volume to identify potential buy or sell signals. By analyzing historical price patterns, investors can gain insights into the stock's future price trajectory. Technical indicators, such as moving averages, relative strength index (RSI), and MACD, provide valuable information for making trading decisions.

GWAV stock has exhibited a bullish trend in recent months, with strong upward momentum. The stock's price has consistently traded above key support levels, indicating a favorable outlook for potential investors. However, it's essential to combine technical analysis with fundamental analysis for a comprehensive understanding of GWAV stock's potential.

Growth Prospects

GWAV's growth prospects are a key consideration for investors evaluating the stock's potential. The company's commitment to innovation and expansion into new markets positions it well for future growth. GWAV's strategic initiatives, such as product diversification and geographic expansion, are expected to drive revenue growth in the coming years.

Furthermore, GWAV's focus on sustainability and corporate social responsibility aligns with increasing consumer preferences for environmentally-friendly solutions. By prioritizing sustainability, GWAV can tap into new customer segments and enhance its brand reputation, contributing to long-term growth prospects.

Risks and Challenges

Investing in GWAV stock is not without risks and challenges. The company's exposure to a rapidly changing industry landscape and intense competition poses potential threats to its market position. Additionally, economic uncertainties and geopolitical tensions can impact GWAV's operations and financial performance.

It's crucial for investors to carefully assess these risks and consider their risk tolerance before investing in GWAV stock. By staying informed about potential challenges and mitigating risks through diversification, investors can make more informed investment decisions.

Investment Strategies

Developing a sound investment strategy is essential for maximizing returns and minimizing risks associated with GWAV stock. Investors should consider a long-term approach, focusing on the company's growth prospects and market position. Diversifying investments across different asset classes and sectors can also help mitigate risks and enhance portfolio performance.

Furthermore, staying informed about market trends and regularly reviewing investment portfolios can enable investors to make timely adjustments and capitalize on emerging opportunities. By adopting a disciplined and proactive investment approach, investors can navigate the complexities of the stock market more effectively.

Buy or Sell Decision: GWAV Stock

Deciding whether to buy or sell GWAV stock requires careful consideration of various factors. Investors should evaluate the company's financial performance, market position, and growth prospects, as well as industry trends and expert opinions. Conducting thorough research and seeking advice from financial professionals can provide valuable insights for making informed investment decisions.

Ultimately, the decision to buy or sell GWAV stock should align with individual investment goals, risk tolerance, and time horizon. By taking a comprehensive approach and considering all relevant factors, investors can make informed choices that align with their financial objectives.

Regulatory Environment

The regulatory environment plays a significant role in shaping GWAV's operations and stock performance. Compliance with industry regulations and standards is crucial for maintaining the company's reputation and avoiding potential legal issues. Changes in regulatory policies can impact GWAV's business operations and financial performance, making it essential for investors to stay informed about regulatory developments.

Investors should consider the potential impact of regulatory changes on GWAV's operations and assess the company's ability to adapt to evolving regulatory requirements. By understanding the regulatory landscape, investors can make more informed decisions regarding GWAV stock.

Dividend Policy

GWAV's dividend policy is an important consideration for investors seeking income-generating investments. The company's ability to consistently pay dividends reflects its financial stability and commitment to returning value to shareholders. Investors should evaluate GWAV's dividend history, payout ratio, and future dividend growth potential when assessing the stock's attractiveness.

While GWAV may prioritize reinvesting profits for growth, a well-balanced dividend policy can enhance shareholder returns and attract income-focused investors. By considering dividend policy alongside other factors, investors can make informed decisions regarding GWAV stock.

Peer Comparison

Comparing GWAV with its industry peers provides valuable insights into the company's competitive position and market performance. By analyzing key financial metrics, market share, and growth prospects, investors can assess GWAV's relative strengths and weaknesses. Peer comparison can also help identify potential investment opportunities and inform buy or sell decisions.

Investors should consider factors such as product offerings, market reach, and financial performance when comparing GWAV with its peers. By gaining a comprehensive understanding of the competitive landscape, investors can make more informed investment decisions regarding GWAV stock.

Investor Sentiment

Investor sentiment plays a crucial role in determining GWAV stock's price movements. Market perceptions and trends can influence investor behavior, leading to fluctuations in stock prices. Monitoring investor sentiment can provide valuable insights into potential buying or selling opportunities.

Social media platforms, news articles, and analyst reports are valuable sources of information for gauging investor sentiment. By staying informed about market trends and investor perceptions, investors can make more informed decisions regarding GWAV stock.

Frequently Asked Questions

- What factors should I consider before buying GWAV stock?

Consider the company's financial performance, market position, growth prospects, industry trends, and expert opinions before buying GWAV stock.

- Is GWAV stock a good long-term investment?

GWAV's growth prospects and strong market position make it a potentially attractive long-term investment. However, investors should conduct thorough research and consider their risk tolerance before making investment decisions.

- What are the risks associated with investing in GWAV stock?

Risks include exposure to industry competition, economic uncertainties, and regulatory changes that could impact GWAV's operations and financial performance.

- How can I stay informed about GWAV stock's performance?

Stay informed by monitoring financial news, analyst reports, and industry trends. Regularly review GWAV's financial statements and market performance for up-to-date information.

- What is the current dividend policy of GWAV?

GWAV's dividend policy reflects its financial stability and commitment to returning value to shareholders. Evaluate the company's dividend history and payout ratio for insights into its dividend policy.

- Should I consult a financial advisor before investing in GWAV stock?

Consulting a financial advisor can provide valuable insights and personalized advice tailored to your investment goals and risk tolerance. It's advisable to seek professional guidance before making investment decisions.

Conclusion

In conclusion, evaluating whether to buy or sell GWAV stock requires a thorough analysis of various factors, including the company's financial performance, market position, and growth prospects. By considering expert opinions, industry trends, and potential risks, investors can make informed decisions that align with their financial objectives. As the stock market continues to evolve, staying informed and adopting a disciplined investment approach is essential for maximizing returns and minimizing risks.

Investing in GWAV stock presents both opportunities and challenges. By conducting comprehensive research and staying informed about market developments, investors can navigate the complexities of the stock market more effectively. Remember to consider your investment goals, risk tolerance, and time horizon when making decisions regarding GWAV stock. With the right approach and careful consideration, investors can make informed choices that contribute to their long-term financial success.

For more information on investing in technology stocks, visit Investopedia's Guide to Technology Stocks.

You Might Also Like

Top Publicly Traded HVAC Companies: A Guide To Industry LeadersMastering The Art Of "236 50": A Comprehensive Guide To Excellence

V.J. Dowling: A Remarkable Journey In The World Of Literature And Beyond

Franklin Mint Collectibles Value: Guide To Understanding Worth

Novelis Stock Price Predictions And Market Dynamics

Article Recommendations

- How Tall Is Ninja Tfue Height Revealed

- Fernando Valdez Bailey Sarian A Leading Expert

- Dde Net Worth 2023 Latest Figures Details