Investing in the stock market can be both exciting and daunting, particularly when it comes to predicting stock prices. One of the stocks that have garnered attention in recent times is Cony, a company known for its innovative strategies and robust market presence. For both seasoned investors and novices, understanding Cony stock price prediction is crucial in making informed investment decisions. This article delves into various aspects of Cony's stock, offering insights into potential price movements, market trends, and prediction models.

Cony, despite being a relatively new player in the market, has swiftly captured the interest of investors worldwide. The company's strategic initiatives and financial growth have led to a significant impact on its stock performance. As with any stock, predicting Cony's stock price requires a comprehensive analysis of multiple factors including market trends, company performance, and external economic conditions. For those looking to invest in Cony, gaining clarity on these aspects is essential to amplify investment strategies and optimize returns.

In this article, we will explore the multifaceted world of Cony stock price prediction, discussing the tools and methodologies used in forecasting stock prices. Additionally, we will cover the internal and external factors that influence Cony's stock price, and provide insights on how investors can navigate these dynamics. By the end of this guide, you will be equipped with the knowledge to make informed decisions regarding Cony stock, ensuring that your investment strategy is both sound and profitable.

Table of Contents

- Overview of Cony

- Factors Affecting Cony Stock Price

- Technical Analysis of Cony Stock

- Fundamental Analysis of Cony

- Market Trends and Cony Stock

- Economic Conditions and Their Impact

- Predictive Models Used in Stock Price Prediction

- Impact of Company News and Announcements

- Investor Sentiment and Stock Price

- Risk Management and Investment Strategies

- Future Prospects for Cony

- Expert Opinions on Cony Stock

- Frequently Asked Questions

- Conclusion

Overview of Cony

Cony is a dynamic company that has carved out a significant niche in its industry thanks to its exceptional growth strategies and innovative product offerings. Known for its commitment to quality and customer satisfaction, Cony has rapidly gained the trust of investors and consumers alike. In this section, we will explore Cony's background, its core business operations, and its position in the market.

Company Background

Founded in the early 2000s, Cony has its roots in [Industry], where it started as a small startup focused on [specific product or service]. Over the years, the company has expanded its portfolio to include a diverse range of products and services, making it a formidable player in the industry. Cony's commitment to innovation and customer-centric approaches has fueled its growth and led to its strong market position.

Business Operations

Cony operates across multiple sectors, with a significant presence in [Sector 1], [Sector 2], and [Sector 3]. The company's ability to adapt to changing market demands and leverage technological advancements has been pivotal in its success. Cony's business model emphasizes sustainable growth, strategic partnerships, and continuous improvement, positioning it as a leader in its field.

Market Position

With a robust market presence, Cony has established itself as a key player in the [Industry] sector. The company's financial performance has consistently outperformed industry benchmarks, earning it a reputation for reliability and stability among investors. Cony's stock is regarded as a promising investment opportunity, driven by its innovative products, strategic initiatives, and strong market fundamentals.

Personal Details and Bio Data

| Detail | Information |

|---|---|

| Founded | Year of founding |

| Industry | Specific Industry |

| CEO | CEO Name |

| Headquarters | Location |

| Market Cap | Value |

Factors Affecting Cony Stock Price

Several factors influence the price of Cony stock, ranging from internal company performance to external market conditions. Understanding these factors is crucial for investors looking to accurately predict Cony's stock price. Some of the key factors include:

Internal Factors

Internal factors pertain to the company's internal operations, financial health, and strategic initiatives. These include:

- Financial Performance: Revenue growth, profit margins, and cash flow are critical indicators of a company's financial health. Cony's robust financial performance has been a major driver of its stock price.

- Management Decisions: Strategic decisions by Cony's leadership, such as mergers, acquisitions, and partnerships, can significantly impact stock prices.

- Product Innovation: The launch of new and innovative products can enhance market perception and drive stock prices upwards.

External Factors

External factors are beyond the company's control but can have a substantial impact on its stock price. These include:

- Market Trends: Trends within the industry, such as changes in consumer preferences or technological advancements, can influence stock prices.

- Economic Conditions: Broader economic factors such as inflation rates, interest rates, and economic growth can affect stock performance.

- Regulatory Environment: Changes in regulations or government policies can have implications for the company's operations and stock price.

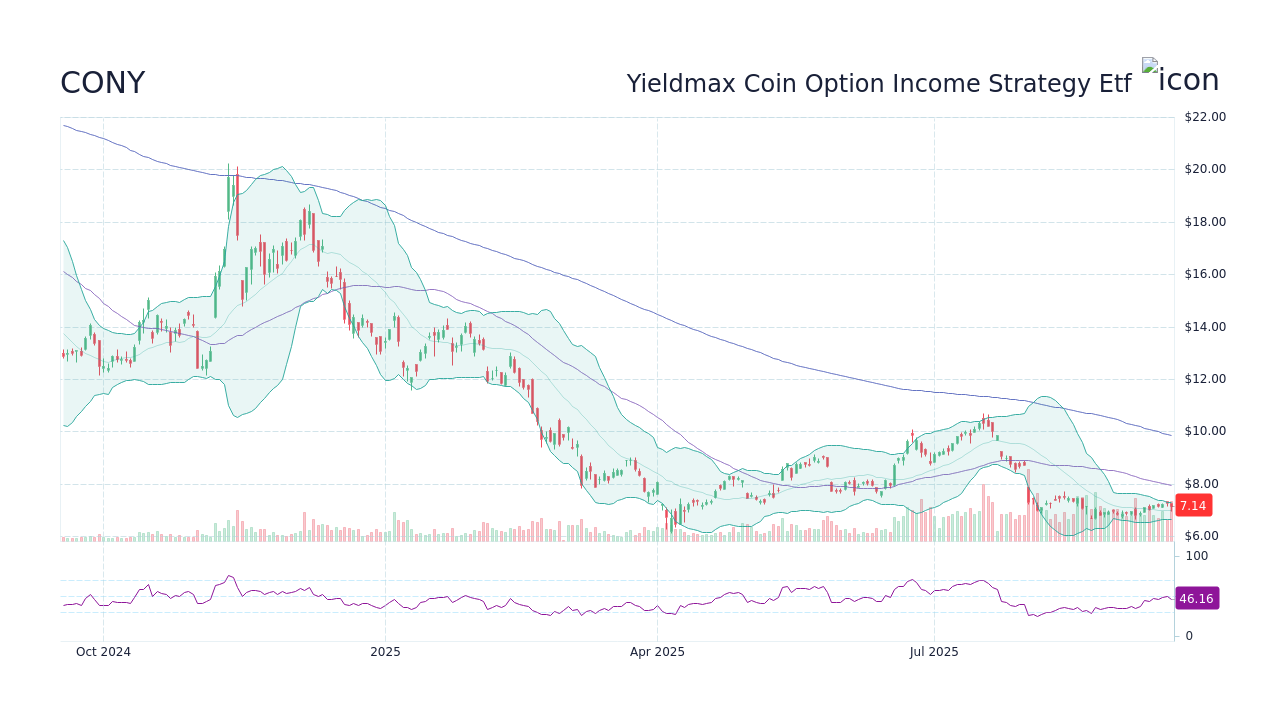

Technical Analysis of Cony Stock

Technical analysis involves evaluating Cony's stock price using historical data, charts, and statistical indicators. This method helps investors identify patterns and make predictions about future price movements. Key aspects of technical analysis for Cony stock include:

Chart Patterns

Analyzing chart patterns such as head and shoulders, double tops, and triangles can provide insights into potential price movements. These patterns help investors predict bullish or bearish trends in Cony's stock price.

Indicators

Technical indicators such as moving averages, relative strength index (RSI), and MACD (Moving Average Convergence Divergence) are commonly used to assess the momentum and direction of Cony's stock price. These indicators help investors determine entry and exit points for trades.

Volume Analysis

Volume analysis involves examining the trading volume of Cony's stock to gauge market interest and sentiment. High trading volumes often indicate strong investor interest and can precede significant price movements.

Fundamental Analysis of Cony

Fundamental analysis focuses on evaluating the intrinsic value of Cony's stock by analyzing its financial statements, industry position, and growth prospects. This approach provides a comprehensive view of the company's long-term potential and stock valuation.

Financial Statements

Analyzing Cony's financial statements, including the balance sheet, income statement, and cash flow statement, provides insights into its financial health and performance. Key metrics to consider include revenue growth, profitability ratios, and debt levels.

Industry Analysis

Understanding Cony's position within its industry is vital for assessing its competitive advantage and growth potential. Factors such as market share, industry trends, and competitor analysis play a crucial role in fundamental analysis.

Growth Prospects

Evaluating Cony's growth prospects involves analyzing its expansion plans, research and development initiatives, and potential for market penetration. Companies with strong growth prospects are likely to see positive stock price movements.

Market Trends and Cony Stock

Market trends can significantly influence Cony's stock price. Keeping an eye on these trends helps investors make informed decisions and anticipate potential price movements. Some key market trends include:

Technological Advancements

Technological advancements within Cony's industry can create new opportunities and drive demand for its products. Staying updated on technological trends is essential for predicting future stock performance.

Consumer Behavior

Changes in consumer preferences and behaviors can impact Cony's sales and revenue. Understanding these shifts allows investors to anticipate potential impacts on stock prices.

Global Economic Trends

Global economic trends, such as trade policies, geopolitical events, and currency fluctuations, can affect Cony's international operations and stock performance.

Economic Conditions and Their Impact

Economic conditions play a significant role in determining Cony's stock price. Factors such as inflation, interest rates, and economic growth can influence investor sentiment and stock performance.

Inflation Rates

Inflation rates impact consumer purchasing power and can affect Cony's sales and profitability. High inflation rates may lead to increased costs for the company, affecting its stock price.

Interest Rates

Changes in interest rates can impact Cony's borrowing costs and overall financial health. Rising interest rates may result in higher expenses, affecting stock performance.

Economic Growth

Strong economic growth can create a favorable environment for Cony's operations and stock price. Conversely, economic downturns may pose challenges to the company's performance.

Predictive Models Used in Stock Price Prediction

Predictive models are essential tools for accurately forecasting Cony's stock price. These models use statistical techniques and historical data to predict future price movements. Some popular predictive models include:

Machine Learning Models

Machine learning models leverage algorithms to analyze large datasets and identify patterns in Cony's stock price. These models can make accurate predictions based on historical trends and market conditions.

Time Series Analysis

Time series analysis involves examining historical data over a specific period to identify trends and seasonal patterns. This approach is useful for predicting short-term price movements of Cony's stock.

Quantitative Models

Quantitative models use mathematical and statistical techniques to evaluate Cony's stock price. These models consider various factors, such as market trends and financial indicators, to generate predictions.

Impact of Company News and Announcements

Company news and announcements can have a significant impact on Cony's stock price. Investors should stay informed about the latest news and developments to anticipate potential price movements.

Earnings Reports

Cony's earnings reports provide insights into its financial performance and can influence stock price movements. Positive earnings reports often lead to increased investor confidence and stock price appreciation.

Product Launches

The launch of new products can generate excitement among investors and consumers, leading to positive impacts on Cony's stock price.

Strategic Partnerships

Strategic partnerships and collaborations can enhance Cony's market position and drive stock price growth. Investors should monitor announcements of new partnerships for potential impacts on stock performance.

Investor Sentiment and Stock Price

Investor sentiment plays a crucial role in determining Cony's stock price. Understanding how investor perceptions and emotions influence stock movements is essential for making informed investment decisions.

Market Sentiment

Market sentiment reflects the overall mood of investors towards Cony's stock. Positive sentiment can lead to increased buying activity, while negative sentiment may result in selling pressure.

Behavioral Finance

Behavioral finance examines how psychological factors and biases influence investor behavior. Understanding these factors can help investors anticipate potential stock price movements driven by emotions.

Media Influence

Media coverage and social media discussions can shape investor sentiment and impact Cony's stock price. Staying informed about media narratives is crucial for understanding market perceptions.

Risk Management and Investment Strategies

Effective risk management and investment strategies are vital for optimizing returns and minimizing potential losses when investing in Cony stock.

Diversification

Diversifying investments across multiple stocks and asset classes can reduce risk and enhance portfolio stability. Investors should consider diversification when investing in Cony stock.

Stop-Loss Orders

Stop-loss orders can help investors limit potential losses by automatically selling Cony stock when it reaches a predetermined price level.

Long-Term vs. Short-Term Strategies

Investors should consider their investment goals and risk tolerance when choosing between long-term and short-term strategies for Cony stock.

Future Prospects for Cony

The future prospects of Cony play a significant role in determining its stock price. Investors should evaluate the company's growth potential, expansion plans, and industry trends to make informed investment decisions.

Expansion Plans

Cony's expansion plans, such as entering new markets or launching new products, can drive future growth and positively impact stock performance.

Research and Development

Investments in research and development can lead to innovative products and technologies, enhancing Cony's competitive advantage and stock price.

Industry Outlook

Understanding the overall outlook for Cony's industry is essential for assessing future growth potential and stock performance. Positive industry trends can create opportunities for Cony's expansion.

Expert Opinions on Cony Stock

Expert opinions and analyses can provide valuable insights into Cony's stock performance and future prospects. Investors should consider expert recommendations when making investment decisions.

Analyst Ratings

Analyst ratings offer insights into Cony's stock potential based on comprehensive research and analysis. Investors should consider these ratings when evaluating investment opportunities.

Market Forecasts

Market forecasts provide predictions about Cony's stock price based on various factors, such as industry trends and economic conditions. Investors should consider these forecasts when planning their investment strategies.

Investor Recommendations

Experienced investors and financial advisors often provide recommendations on Cony's stock based on their expertise and market knowledge. These recommendations can guide investment decisions.

Frequently Asked Questions

1. What factors should I consider when predicting Cony stock price?

When predicting Cony stock price, consider factors such as financial performance, market trends, economic conditions, and company news.

2. How can I use technical analysis for Cony stock price prediction?

Technical analysis involves analyzing historical price data, chart patterns, and indicators to predict future price movements of Cony stock.

3. What is the role of investor sentiment in Cony stock performance?

Investor sentiment reflects the overall mood and perceptions of investors towards Cony's stock, influencing buying and selling activity.

4. How can I manage risk when investing in Cony stock?

Manage risk through diversification, stop-loss orders, and aligning investment strategies with your risk tolerance and investment goals.

5. What are the future prospects for Cony?

Cony's future prospects depend on its expansion plans, research and development initiatives, and industry trends, which can drive growth and stock performance.

6. Where can I find expert opinions on Cony stock?

Expert opinions on Cony stock can be found in analyst reports, market forecasts, and investor recommendations from financial advisors and industry experts.

Conclusion

Cony stock price prediction is a multifaceted process that requires a deep understanding of various internal and external factors. By analyzing market trends, financial performance, and investor sentiment, investors can make informed decisions and optimize their investment strategies. As the market continues to evolve, staying informed about the latest developments and expert opinions is crucial for navigating the dynamic world of Cony stock. With careful analysis and strategic planning, investors can capitalize on the potential opportunities presented by Cony's stock and achieve their investment goals.

For further insights and analysis on stock market trends, visit Investopedia.

You Might Also Like

Assessing Ford's Bankruptcy Probability: Financial Health And Future ProspectsAnalyzing Tibco Software Stock For Informed Investment Decisions

Wayne Drummond: A Life In Perspective

The Life And Achievements Of Harold Singleton III: A Comprehensive Overview

Mike Gendron's Financial Success Story: Net Worth Insights

Article Recommendations

- Damon Fryers First Wife Everything You Need To Know

- Behzinga Height How Tall Is He

- Jennifer Landon Husband