Investing in the stock market is a journey that requires careful consideration and strategic planning. One of the pivotal decisions investors face is selecting the right stocks to buy. In this context, Aehr Test Systems has emerged as a topic of interest among investors. With its innovative approach in the semiconductor industry, many are keen to understand whether Aehr is a good stock to buy. In this article, we will delve into the various aspects that make Aehr Test Systems a potential investment opportunity, exploring its financial health, market position, and future prospects.

Investors are often drawn to Aehr Test Systems due to its unique positioning in the semiconductor testing market. The company has been making waves with its cutting-edge solutions and strong technological advancements. However, like any investment, there are risks and rewards to consider. This article aims to provide an in-depth analysis of Aehr Test Systems, evaluating its financial performance, growth potential, competitive landscape, and more. By understanding these elements, investors can make informed decisions about whether or not Aehr is a suitable addition to their portfolio.

Moreover, the semiconductor industry is undergoing rapid transformation, with increasing demand for efficient and reliable testing solutions. Aehr Test Systems has positioned itself as a key player in this evolving landscape. Through this comprehensive article, we aim to provide insights and data-driven analysis that reflects the company's current standing and future outlook. Whether you're a seasoned investor or a newcomer to the stock market, this article will equip you with the knowledge needed to assess if Aehr is a promising stock to buy.

Table of Contents

- Financial Performance

- Competitive Landscape

- Market Trends

- Technological Advancements

- Management and Leadership

- Investment Risks

- Growth Potential

- Stock Performance

- Dividends and Returns

- Analyst Recommendations

- Investor Sentiment

- Regulatory Environment

- Sustainability Efforts

- Future Outlook

- Frequently Asked Questions

Financial Performance

Aehr Test Systems' financial performance is a crucial indicator of its stability and potential for growth. Over the past few years, Aehr has shown a consistent pattern of revenue growth, driven by increased demand for its semiconductor test and burn-in products. The company's ability to maintain profitability while investing in research and development is noteworthy. Investors should pay close attention to Aehr's balance sheet, income statement, and cash flow to evaluate its financial health.

The company's revenue streams are diversified across various sectors in the semiconductor industry, which helps mitigate risks associated with reliance on a single market segment. Aehr's financial ratios, including the price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio, provide insights into its financial stability and operational efficiency. Additionally, Aehr's strategic partnerships and collaborations have contributed to its financial success, positioning it as a formidable player in the semiconductor testing market.

Competitive Landscape

Understanding Aehr Test Systems' position within the competitive landscape is vital for assessing its long-term viability. The semiconductor testing industry is highly competitive, with numerous players vying for market share. Aehr distinguishes itself through its innovative products and solutions, which cater to the evolving needs of the semiconductor industry. The company's focus on delivering high-quality and reliable testing solutions has helped it build a strong reputation among clients and partners.

Key competitors in the market include established companies such as Advantest, Teradyne, and Cohu. Each competitor offers unique strengths and weaknesses, and Aehr's ability to differentiate itself through technology and customer service is critical. By analyzing the competitive dynamics, investors can gauge Aehr's potential to maintain and grow its market share in the face of stiff competition.

Market Trends

The semiconductor industry is characterized by rapid technological advancements and shifting market trends. Aehr Test Systems is well-positioned to capitalize on these trends, particularly the growing demand for semiconductor testing solutions. The rise of technologies such as 5G, artificial intelligence, and the Internet of Things (IoT) has increased the complexity of semiconductor devices, driving the need for more sophisticated testing methods.

Aehr's focus on developing cutting-edge solutions aligns with these market trends, and its investment in research and development ensures that it stays ahead of the curve. Furthermore, the global push for digital transformation and automation presents additional opportunities for growth. By keeping a pulse on market trends, investors can better understand Aehr's potential for future success.

Technological Advancements

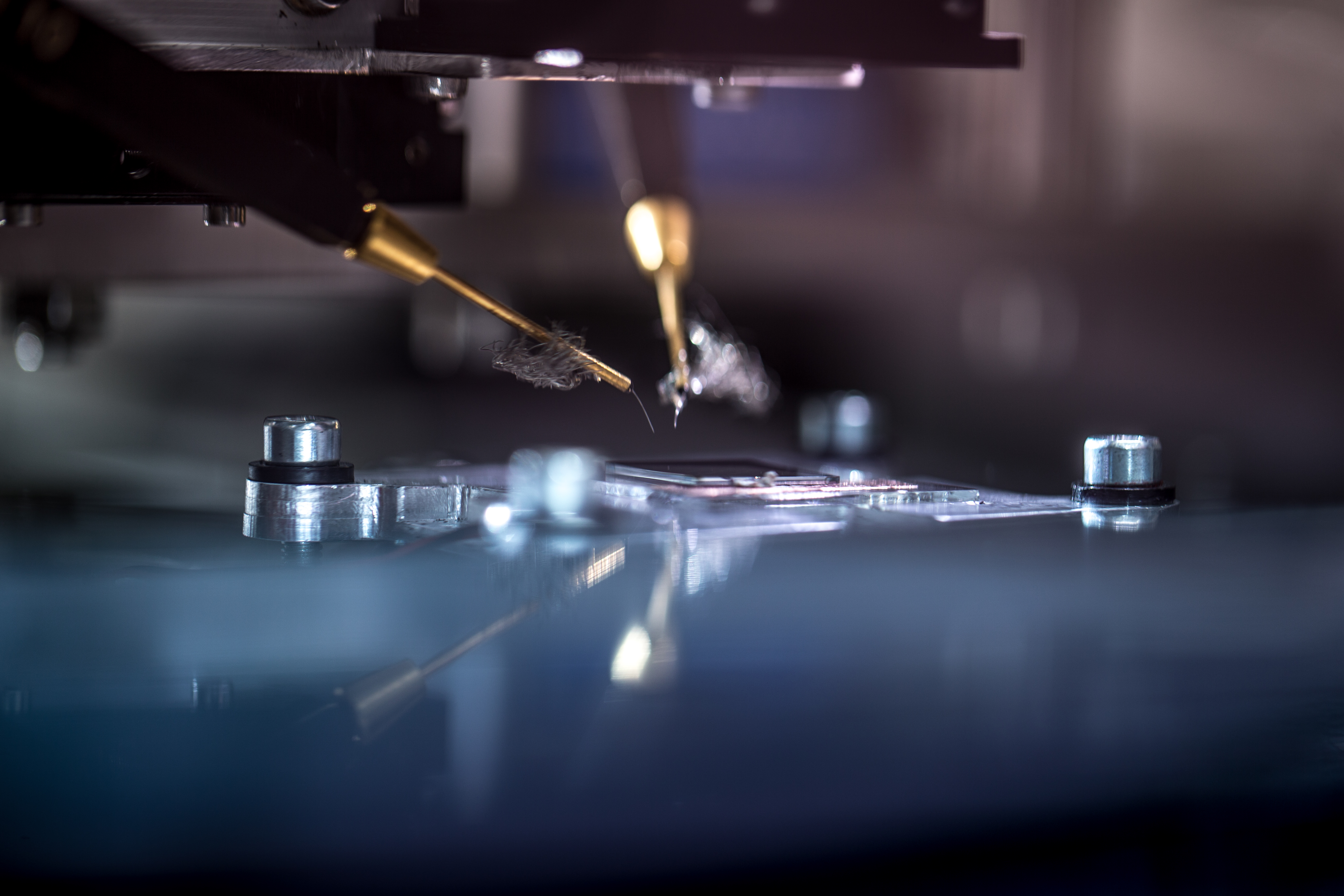

Innovation is at the heart of Aehr Test Systems' business strategy. The company's commitment to technological advancements has enabled it to deliver state-of-the-art testing solutions that meet the ever-evolving needs of the semiconductor industry. Aehr's product portfolio includes a range of advanced test and burn-in systems that offer high precision and efficiency.

Aehr's focus on developing proprietary technologies and intellectual property has given it a competitive edge in the market. By continuously enhancing its product offerings, Aehr ensures that it remains a leader in the semiconductor testing space. Investors should consider Aehr's technological capabilities and innovation track record when evaluating its potential as a stock to buy.

Management and Leadership

Effective management and leadership play a crucial role in a company's success. Aehr Test Systems boasts a team of experienced executives who have successfully steered the company through various industry challenges. The leadership team's strategic vision and ability to execute on its goals have been instrumental in driving Aehr's growth and market presence.

Aehr's management team is committed to fostering a culture of innovation and excellence, which is reflected in the company's strong performance and customer satisfaction. By evaluating the leadership team's experience and track record, investors can gain insights into Aehr's potential to navigate future challenges and capitalize on opportunities.

Investment Risks

As with any investment, there are inherent risks associated with buying Aehr Test Systems stock. Investors should be aware of potential risks, including market volatility, technological disruptions, and macroeconomic factors. Aehr's reliance on a limited number of key customers and suppliers could also pose challenges in the event of supply chain disruptions or shifts in customer demand.

Additionally, the semiconductor industry's cyclical nature can impact Aehr's financial performance. Investors should consider these risks and assess their risk tolerance before making investment decisions. By understanding the potential pitfalls, investors can make informed choices about whether Aehr aligns with their investment strategy.

Growth Potential

Aehr Test Systems' growth potential is a key consideration for investors. The company's strong market position and innovative product offerings provide a solid foundation for future expansion. Aehr's strategic initiatives, including expanding its customer base and exploring new markets, contribute to its growth prospects.

The increasing demand for semiconductor testing solutions, driven by technological advancements and digital transformation, presents substantial opportunities for Aehr. By capitalizing on these trends and executing its growth strategy, Aehr has the potential to deliver significant returns to investors. Evaluating Aehr's growth potential helps investors determine if it is a good stock to buy for long-term gains.

Stock Performance

Aehr Test Systems' stock performance provides valuable insights into its market perception and investor sentiment. By analyzing historical stock trends, investors can identify patterns and assess the stock's volatility and stability. Aehr's stock performance is influenced by various factors, including financial results, industry developments, and macroeconomic conditions.

Investors should consider Aehr's stock performance in relation to broader market trends and benchmark indices. Understanding how Aehr's stock has performed in different market conditions can help investors make informed decisions about its potential as a long-term investment.

Dividends and Returns

Dividends and returns are important factors for investors seeking income and capital appreciation. Aehr Test Systems' dividend policy and historical returns provide insights into its ability to generate shareholder value. While Aehr may not be known for high dividend yields, its focus on reinvesting profits into research and development contributes to long-term growth.

Investors should consider Aehr's total return, including capital gains and dividends, when evaluating its attractiveness as an investment. By assessing the company's dividend history and potential for future returns, investors can determine if Aehr aligns with their investment goals.

Analyst Recommendations

Analyst recommendations offer valuable insights into Aehr Test Systems' market perception and potential. Industry analysts evaluate Aehr's financial performance, market position, and growth prospects to provide buy, hold, or sell recommendations. These recommendations are based on extensive research and analysis, providing investors with expert opinions.

Investors should consider analyst recommendations as part of their decision-making process, while also conducting their own research and analysis. By understanding the consensus view and rationale behind analyst recommendations, investors can make informed choices about Aehr's potential as a stock to buy.

Investor Sentiment

Investor sentiment reflects the collective mood and perception of the market towards a particular stock. Aehr Test Systems' investor sentiment is influenced by various factors, including financial performance, industry developments, and market trends. Positive sentiment can drive stock prices higher, while negative sentiment can lead to declines.

Investors should monitor Aehr's investor sentiment through market news, social media, and forums to gauge how the stock is perceived by the broader investment community. By understanding investor sentiment, investors can make more informed decisions about Aehr's potential as a stock to buy.

Regulatory Environment

The regulatory environment plays a significant role in Aehr Test Systems' operations and market dynamics. The semiconductor industry is subject to various regulations and compliance requirements that can impact Aehr's business. Investors should be aware of regulatory changes and their potential effects on Aehr's operations and financial performance.

Understanding the regulatory landscape helps investors assess the risks and opportunities associated with Aehr's business. By staying informed about regulatory developments, investors can make informed decisions about Aehr's potential as a stock to buy.

Sustainability Efforts

Sustainability is becoming increasingly important for investors and companies alike. Aehr Test Systems' commitment to sustainability and environmental responsibility can impact its market perception and long-term success. Investors should consider Aehr's sustainability initiatives and efforts to minimize its environmental footprint.

Aehr's focus on sustainability aligns with global trends towards environmentally responsible business practices. By evaluating Aehr's sustainability efforts, investors can assess its potential to meet the growing demand for sustainable solutions and create long-term value.

Future Outlook

The future outlook for Aehr Test Systems is shaped by various factors, including market trends, technological advancements, and strategic initiatives. Aehr's ability to capitalize on emerging opportunities and navigate industry challenges will determine its long-term success.

Investors should consider Aehr's strategic vision, growth initiatives, and market positioning when evaluating its future prospects. By assessing Aehr's future outlook, investors can make informed decisions about its potential as a stock to buy.

Frequently Asked Questions

1. What makes Aehr Test Systems unique in the semiconductor industry?

Aehr Test Systems is known for its innovative semiconductor test and burn-in solutions. The company's focus on delivering high-quality and reliable testing products sets it apart from competitors. Aehr's commitment to technological advancements and customer satisfaction has helped it build a strong reputation in the industry.

2. How has Aehr Test Systems performed financially in recent years?

Aehr Test Systems has shown consistent financial growth, driven by increased demand for its products and strategic partnerships. The company's revenue growth and profitability indicate its strong financial health and ability to navigate industry challenges.

3. What are the key risks associated with investing in Aehr Test Systems?

Investing in Aehr Test Systems involves risks such as market volatility, technological disruptions, and macroeconomic factors. The company's reliance on a limited number of key customers and suppliers could also pose challenges in the event of supply chain disruptions or shifts in customer demand.

4. What is Aehr Test Systems' growth potential?

Aehr Test Systems has significant growth potential due to its strong market position, innovative product offerings, and strategic initiatives. The increasing demand for semiconductor testing solutions, driven by technological advancements, presents substantial opportunities for growth.

5. How do analysts perceive Aehr Test Systems stock?

Analysts provide buy, hold, or sell recommendations for Aehr Test Systems based on extensive research and analysis. These recommendations offer valuable insights into Aehr's market perception and potential. Investors should consider analyst recommendations as part of their decision-making process.

6. How does Aehr Test Systems contribute to sustainability?

Aehr Test Systems is committed to sustainability and environmental responsibility. The company's focus on minimizing its environmental footprint and promoting sustainable business practices aligns with global trends towards environmentally responsible solutions.

In conclusion, Aehr Test Systems presents a compelling investment opportunity with its strong market position, innovative products, and growth potential. However, investors should carefully consider the risks and perform thorough research before making investment decisions. By understanding Aehr's financial performance, competitive landscape, and future prospects, investors can make informed choices about whether Aehr is a good stock to buy.

You Might Also Like

Fishing Adventures In Negril, Jamaica: A Guide To Tropical AnglingScott Hartz: A Visionary Leader Transforming The Business Landscape

Thimble Insurance Customer Service: Enhancing Your Experience

Massimo Deli Menu: Culinary Delights Await

Efficient Vireo Health Medical Marijuana Delivery Service

Article Recommendations

- Frank Bollock Exclusive News Insights

- Bunny And Dogman Still Together Real Life Update

- Jesse Nelk Net Worth 2023 A Deep Dive